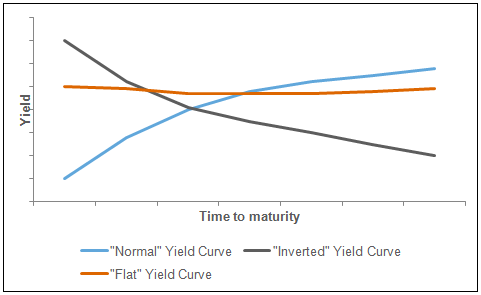

The yield curve is the spread, or slope, between short-term and long-term interest rates. A normal curve is when long-term rates are higher than short-term rates (upward slope), as opposed to when it’s inverted and the opposite is true (downward slope). The spread between the two is mainly determined by short-term rates, since those are the ones whose direction is controlled by Federal Reserve (Fed) policy. Long-term rates mainly move depending on investors’ expectations of inflation. When the yield curve is described as flattening, typical during an economic recovery, it usually just means that short-term rates are rising faster than long-term rates, flattening the spread between the two. Investors closely watch the yield curve, as an inverted curve usually signals the end of an economic recovery and the beginning of an economic contraction. During a recession, the Fed lowers short-term rates in an effort to boost economic activity by making it cheaper to borrow money, bringing the yield curve back to normal.